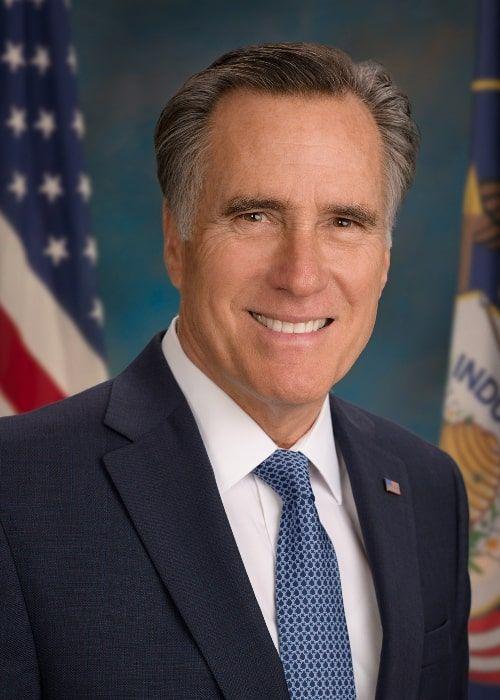

Mitt Romney

Mitt Romney was born in Detroit, Michigan, United States on March 12th, 1947 and is the Politician. At the age of 77, Mitt Romney biography, profession, age, height, weight, eye color, hair color, build, measurements, education, career, dating/affair, family, news updates, and networth are available.

At 77 years old, Mitt Romney has this physical status:

Willard Mitt Romney (born March 12, 1947) is an American politician and businessman serving as the junior United States senator from Utah since January 2019.

He served as the governor of Massachusetts from 2003 to 2007 and was the Republican Party's nominee for President of the United States in the 2012 election. George and Lenore Romney, his parents, were born in Bloomfield Hills, Michigan, and he served as a Mormon missionary in France for two-and-a-half years, beginning in 1966.

He married Ann Davies in 1969, and they have five children together.

He had been active in both parents' political campaigns by 1971.

Romney earned a Bachelor of Arts in English from Brigham Young University (BYU) in 1971 and a joint JD–MBA from Harvard University in 1975.

In 1977, Romney began working as a Boston management consultant, and in 1977, he took over Bain & Company.

Early life and education

Willard Mitt Romney was born in Detroit, Michigan, on March 12, 1947, as one of four children born to automobile executive George W. Romney and former actress and homemaker Lenore Romney (née LaFount). His mother was a resident of Logan, Utah, and his father was born in a Mormon colony in Chihua, Mexico. He has Scottish and German roots, despite being mainly English- descent. He is a fifth-generation member of the LDS Church and a great-grandson of Miles Romney, who converted to Mormonism in the first decade. Parley P. Pratt, a great-grandfather, was a leader of the early church.

Margo, Jane, and Scott are Romney's three older siblings. Mitt was the youngest person to have been alive for nearly six years. His parents named him after a family friend, businessman J. Willard Marriott, and his father's cousin, Milton "Mitt" Romney, a former Bears quarterback. When Romney declared a preference for "Mitt," he was called "billy" before kindergarten. The family moved from Detroit to Bloomfield Hills, Florida, where his father became the chairman and CEO of American Motors the following year, assisting the firm in avoiding bankruptcy and restoring profitability. His father was a nationally known figure in print and television by 1959, and Mitt idolized him.

Since being one of only a few Mormon students at Cranbrook School, a private upscale boys' preparatory academy just a few miles away from his home, Romney attended public elementary schools until seventh grade. Many students there came from backgrounds even more wealthy than his. He was not particularly gifted, but academically, he did not distinguish himself. He served as an intern in the governor's office during his father's highly acclaimed 1962 Michigan gubernatorial bid and later served as an intern. When his newly elected father began spending the majority of his time in Cranbrook, Romney took up residence in Cranbrook.

Romney also served as the ice hockey team's manager and joined the pep squad at Cranbrook. He joined the cross country running team in his senior year. He belonged to 11 schools and clubs, including the Blue Key Club, a booster group he had joined. His academic record improved during his last year there but fell short of excellence. When attending Cranbrook, Romney was involved in several pranks. He has since apologised for them, acknowledging that some of them may have gone too far. Ann Davies began dating Ann Davies in March; she attended Cranbrook's private Kingswood School. Around the time he graduated from high school in June 1965, the two became officially involved.

During the 1965–66 academic year, Romney taught Stanford University. He was not part of the counterculture that was then thriving in the San Francisco Bay Area. A gang staged a sit-in at Stanford's administration building in May 1966 to protest against draft status tests; Romney mounted a counterprotest against that group. He continued to enjoy occasional pranks.

He began a 30-month stint in France as a Mormon missionary, a common rite of passage in his families. He landed in Le Havre, where he shared squashed quarters under meager circumstances. Alcoholic, smoking, and dating prohibitions were strictly followed. On average, individual Mormon missionaries do not gain many converts, and Romney was no exception: he later estimated 10 to 20 for his entire mission. He was initially demoralized, but later remembered it as the only time when "the majority of what I was trying to do was refused." He soon earned respect for the many homes he called on and the repeated visits he was allowed. In early 1968, he became a city leader in Bordeaux and then became an assistant to the mission president in Paris. He loved a mansion that was much more comfortable than the ones he had encountered elsewhere in the country. When the French pled opposition to the US's involvement in the Vietnam War, Romney debated them. Many who yelled at him and slammed their doors in his face merely affirmed his resolve.

In June 1968, he was in southern France and operating an automobile that was struck by another car, which seriously injured him and killed one of his passengers, the mission president's wife. After the national strike and student student rebellions in May 1968, Romney became co-president of a mission that had been demoralized and disorganized. The mission met its target of 200 baptisms for the year, the most in a decade, with Romney rallying the others. He was supervising the work of 175 others by the end of his time in December 1968. Romney developed a lifelong passion for France and its peoples and has continued to speak fluent in French as a result of his stay there.

Following his return, Romney and Ann Davies reunited and decided to marry at their first meeting. Romney came from Utah and enrolled in Brigham Young University, where Ann had been studying. They married in Bloomfield Hills on March 21, 1969, and the next day, they travelled to Utah for a Mormon wedding ceremony at the Salt Lake Temple; Ann had converted to the faith while away.

While in France, Romney had missed a significant anti-Vietnam War movement in America. On his return to office, he was surprised to learn that his father was involved in the movement even before his unsuccessful 1968 presidential bid. George was recently serving as the United States Secretary of Housing and Urban Development in President Richard Nixon's cabinet. Mitt said that US involvement in the war had been misguided, "If it wasn't a political blunder to move to Vietnam, I don't know what is" – but that Nixon's continuing Cambodian Insurgent attempt to end the conflict as a sincere effort to end the war. Romney sought and received two 2-S student deferments, followed by a 4-D ministerial deferment while living in France as a missionary during the Vietnam War. He later applied for and received two additional student deferrals. He drew number 300 in the December 1969 draft lottery, assuaging that he would not be drafted.

Romney remained distant from much of the period's upheaval. He became president of the Cougar Club booster group and demonstrated a new degree of discipline in his studies. He took a leave of absence to serve as both a driver and advance man for his mother's unsuccessful bid for the U.S. Senate, and the two of them visited all 83 Michigan counties during his senior years. Romney earned a Bachelor of Arts degree in English and a 3.97 GPA in 1971. He gave commencement addresses to both the College of Humanities and the entire BYU.

Taggart, the Romneys' first son, was born in 1970 while studying in a basement apartment. Matthew and Joshua were born in 1971 and 1975 respectively, and Joshua was born in 1975. After Romney's career, Benjamin (1978) and Craig (1981) were born.

Romney wanted to go back to school, but his father told him that a law degree could be helpful to his future, even though he never practiced law. As a result, he enrolled in the recently launched four-year joint Juris Doctor/Master of Business Administration program, which is coordinated between Harvard Law School and Harvard Business School. He quickly adjusted to the company school's more flexible, data-driven case study approach of teaching. Ann and their two children's life in Belmont, Massachusetts, was different from that of most of his classmates. He was nonideological and did not participate himself in the day's political debates. In 1975, Romney graduated from Harvard. He was dubbed a Baker Scholar for graduating in the top 5% of his business school class and receiving his Juris Doctor degree for being in the top third of his law school class.

Business career

Romney took the Michigan bar exam but decided to pursue a career in business rather than law after receiving his JD–MBA from Harvard. He was hired by several large companies but decided against joining the Boston Consulting Group (BCG), figuring out that working as a management consultant for a variety of companies would help prepare him for a future role as a CEO. He found his legal and business education in his work as part of a 1970s wave of top graduates who wanted to go into consulting rather than joining a large corporation directly. Executives regarded him as having a promising future in BCG practices such as the growth-share matrix. He worked at BCG as a colleague of Benjamin Netanyahu with whom he formed a friendship that has spanned decades.

He was recruited by Bain & Company, a Boston management consultancy firm that had existed a few years before by Bill Bain and several other ex-BCG employees. "He had the look of a man who was maybe ten years older," Bain later said of the 30-year-old Romney. Bain & Company, unlike other consultancy companies that made recommendations and then departed, embedded itself in a client's companies and continued to work with them until changes were made. In 1978, Romney became a vice president of the Monsanto Company, Outboard Marine Corporation, Burlington Industries, and Corning Incorporated. Within a few years, the firm named him one of the company's top consultants. In fact, clients used him more often than discerning partners.

During Romney's political campaigns, two family incidents during this period also emerged. Romney told him that his motorcycle had an insufficiently visible license number and that if he took the boat onto the lake, he would face a $50 fine. Romney said he would pay the fine despite dissatisfaction with the license and wanting to keep a family out of it. He was arrested for disorderly conduct by the ranger. The charges were dismissed several days later. He placed the family's dog in a windshield-equipped carrier on the roof of their vehicle in 1983, and then washed the car and carrier after the dog had a bout of diarrhea. The dog incident in particular became a source of fodder for Romney's analysts and political opponents later on.

In 1984, Romney gave Bain & Company a charter to co-found and lead the spin-off private equity investment group Bain Capital. He refused to accept Bill Bain's bid to lead the new venture until Bain renegotiated the terms in a complicated partnership framework, so that there was no financial or occupational risk to Romney. The new business, which had seven employees, needed $37 million to begin. Bain and Romney raised the money to begin. Romney held the positions of president and managing general partner. Despite the fact that he was the sole shareholder of the company, publications referred to him as managing director or CEO.

Bain Capital was initially focusing on venture capital investments. Romney developed a system in which any partner could veto one of these potential offerings, and he personally saw so many flaws that no venture capital investment was allowed in the first two years. The firm's first major success was in 1986 when founder Thomas G. Stemberg told Romney that despite the market size for office supplies and Romney persuaded others; Bain Capital earned a nearly sevenfold return on investment, and Romney sat on the board of directors for over a decade.

Bain Capital's focus changed from startups to leveraged buyouts, whereby purchasing existing businesses were largely borrowed from financial institutions and then selling them when the company's value reached, usually within a few years. Bain Capital lost money in several of its early leveraged buyouts, but later discovered deals that brought substantial returns. The company invested in or acquired Accuride Corporation, Brookstone, Domino's Pizza, Sealy Corporation, Sports Authority, and Artisan Entertainment, as well as other smaller firms in the commercial and medical industries. A substantial portion of the firm's income came from a relatively small number of deals; Bain Capital's overall success-to-failure ratio was about equal.

Romney found few investment opportunities (and those that he did not have to make money for the company in the first place). Rather, he concentrated on investigating the benefits of potential acquisitions based on feedback received and encouraging investors to participate in them once they were approved. Romney used deals within the company to keep people motivated, with some people retaining less than 10% for himself. During extensive analysis of whether or not to go forward with a contract, he often played the role of a devil's advocate. He wanted to pull a Bain Capital hedge fund that had initially lost money, but other partners disagreed with him, and the Bain Capital hedge fund eventually made billions. He dropped out of the Artisan Entertainment contract, not wanting to profit from a R-rated film studio. Romney served on the board of directors of Damon Corporation, a medical testing firm that was later found guilty of defrauding the government; Bain Capital tripled its investment before selling the company; and the fraud was not disclosed by the new owners (Romney was never charged). In some cases, Romney had no involvement with a business until Bain Capital acquired it.

Sometimes, leveraged buyouts by Bain Capital resulted in layoffs either shortly after the acquisition or later after the company had ended its service. Bain Capital's precise number of employees compared to those who were laid off due to a lack of records and Bain Capital's penchant for secrecy for itself and its investors is uncertain. The firm's primary investment goal was to maximize the value of acquired companies and the return to Bain's investors, not job creation. Despite the fact that the company's bankruptcy later went into bankruptcy, Bain Capital's acquisition of Ampad exemplified a deal where it profited handsomely from early payments and administration fees. Dade Behring was another instance where Bain Capital received an eightfold return on investment, but the company itself was saddled with debt and laid off over a thousand employees before Bain Capital was disbanded (the company went into bankruptcy with more layoffs) before recovering and prospering). Romney said in 2007: "While there are times the medication is a little resentful, it is still important to save the patient's life." My job was to try and make the company profitable, but I think the best defense a family could have is that the company they work for is solid."

Bain & Company, a financial company, asked Romney to return in 1990. In January 1991, it was announced as its new CEO, but he received a one-dollar salary (remaining managing general partner of Bain Capital at that time). He oversaw the company's attempt to restructure Bain & Company's employee stock-ownership scheme and real estate deals, as well as boosting fiscal transparency by excluding Bain and the other founding partners from the decision. He ordered Bain and other early owners to recover significant amounts, as well as the Federal Deposit Insurance Corporation, to pay less than half of the loan. He led Bain & Company back to profitability within a year. In December 1992, he handed over the company to new hands and restored it to Bain Capital.

Romney took a leave of absence from Bain Capital from November 1993 to November 1994 to run for the Senate of the United States. Ampad staff went on strike and begged Romney to intervene at that time, prompting Ampad workers to go on strike and begged for help. Romney met the strikers on advice from Bain Capital attorneys, but told them he had no position of active authority in the matter.

Bain Capital was on its way to become one of the country's top private equity companies by 1999, with 115 employees and $4 billion under management. The firm's average annual return to investors was 113%, and its average annual return to investors was around 50%-80%.

Romney took a paid leave of absence from Bain Capital in order to serve as both president and CEO of the 2002 Salt Lake City Olympic Games Organizing Committee beginning in February 1999. Billed in a public statement as a result of his part-time employment, Romney remained the firm's sole shareholder, CEO, and president, signing corporate and legal papers, tending to his company's interests, and starting lengthy talks regarding the terms of his resignation. He did not participate in the firm's day-to-day operations or the company's investment decisions regarding the new private equity funds. During this time, he remained on several boards of directors and regularly returned to Massachusetts to attend meetings.

Romney declared in August 2001 that he did not return to Bain Capital. His resignation from the company came in early 2002; he resigned as the firm's sole shareholder and negotiated an agreement that permitted him to receive a part of the company's profits as a former partner in some Bain Capital firms, including buyout and investment funds. The private equity market continued to thrive, earning him millions of dollars in annual income.