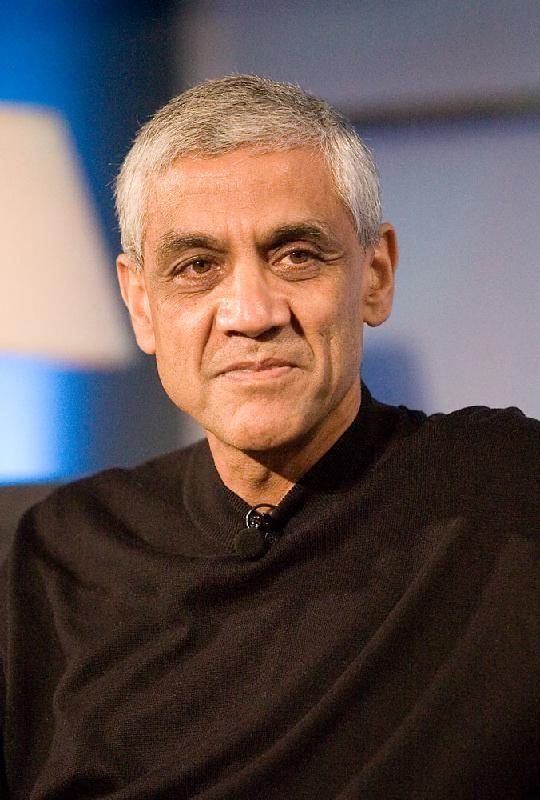

Vinod Khosla

Vinod Khosla was born in Delhi, India on January 28th, 1955 and is the Entrepreneur. At the age of 69, Vinod Khosla biography, profession, age, height, weight, eye color, hair color, build, measurements, education, career, dating/affair, family, news updates, and networth are available.

At 69 years old, Vinod Khosla physical status not available right now. We will update Vinod Khosla's height, weight, eye color, hair color, build, and measurements.

Vinod Khosla (born 28 January 1955) is an Indian billionaire businessman and venture capitalist.

He is a co-founder of Sun Microsystems, LS9, Inc (via Khosla Ventures), and the founder of Khosla Ventures.

Forbes named him one of the nation's richest people in 2014.

He is best known for his failed court struggle to reverse the California Coastal Act and privatize Martins Beach.

Career

After completing his MBA at Stanford in 1980, Khosla developed a business plan for an electronic design automation company for electrical engineers. He was introduced to employees at Intel and became the first full-time founder and Chief Financial Officer of Daisy Systems. The company spent 80 percent of its resources on building custom computer hardware that could run its software. As a result, Khosla left the company in order to create a startup that manufactures general purpose computers. In 1981, Khosla co-founded Data Dump with a former Stanford classmate, which ended up failing.

In 1982, Khosla co-founded Sun Microsystems (SUN is the acronym for the Stanford University Network), along with Stanford classmates Scott McNealy, Andy Bechtolsheim, and UC Berkeley computer science graduate student Bill Joy. Khosla served as the first chairman and CEO from 1982 to 1984, when he left the company to become a venture capitalist.

In 1986, Khosla joined the venture capital firm Kleiner Perkins as a general partner. At Kleiner Perkins, Khosla managed investments in technologies, such as video games and semiconductors.

He also invested in an Indian microfinance company, SKS Microfinance, which lends small loans to poor women in rural India.

In 2004 to spend more time with his teenage kids and focus on technology startups, Khosla moved to part-time and eventually left Kleiner Perkins. He founded his own venture capital firm, Khosla Ventures later that year as a way to invest in more experimental technologies with a "social impact." At the time, he had about $1.5 billion from co-founding Sun Microsystems and his work with Kleiner Perkins. The firm is based in Menlo Park, California.

Khosla was featured on Dateline NBC in May 2006, where he discussed the practicality of ethanol as a gasoline substitute. He is known to have invested heavily in ethanol companies in hopes of widespread adoption.

The firm became known for large, early investments in alternative energy technology like solar, biofuel, and batteries. He has advocated for breakthroughs in these "clean" energies rather than cutting back on energy consumption. The firm incubated carbon recycling and aviation fuel company LanzaTech and QuantumScape, a solid state battery company. Khosla has stated both Quantumscape and Lanzatech are unicorns that have taken time and calls them part of "clean tech 1.0." He believes carbon sequestration is an area that needs significant advancements and is the most feasible. Impossible Foods, which works to make meat a more efficient energy source, and View Glass are also unicorns incubated by Khosla Ventures. Business Insider reported that it took 10 years to return "more than a billion dollars" to the firm, similar to some of Khosla's other successful investments that also took a decade to pay off. Khosla believes that a dozen dramatic technologies to solve climate change and it is inaccurate to continue cleantech investing as a bust.

In September 2009, Khosla Ventures III secured $750 million of investor commitments to invest in traditional early-stage and growth-stage companies. Khosla also raised $250 million for Khosla Seed, which will invest in higher-risk opportunities. He opened up Khosla Ventures to outside investors for the first time that same year.

Beginning in 2010, Khosla Ventures began investing in food and was the first investor in companies like Instacart and DoorDash. Fintech was also an area of focus with early investments. In May 2010, it was announced that former British Prime Minister Tony Blair was to join Khosla Ventures to provide strategic advice regarding investments in technologies focused on the environment. During this time, Khosla had hired Condoleezza Rice's advisory firm to work with portfolio companies. In 2012, Khosla wrote an article titled "Do We Need Doctors Or Algorithms?" arguing the increasing importance of artificial intelligence in medicine claiming "bionic assistance" will eventually replace most doctors. He started investing in medicine and robotics, such as companies that use artificial intelligence in medical treatments at that time. Khosla Ventures also invested in HackerRank.

In 2018, Khosla stated the plan for the rest of his life was to "reinvent societal infrastructure" through innovation and technology such as 3D-printing houses for the homeless. Khosla has stated "we need 1,000% change if billions of people in China and India are to enjoy a Western, energy-rich lifestyle." He invests in "black swan" technologies that have a high chance of failure but if successful, would have environmental and societal benefits. In 2019, Khosla presented "Amazing: What KV Founders are Doing," which described 100 portfolio companies reinventing areas such as health, infrastructure, robotics, transportation, augmented reality and artificial intelligence.

Khosla Ventures manages approximately $15 billion of investor capital as well as investments funded by Khosla himself. In 2021, he was listed No. 92 on the Forbes 400 list of the richest people in the US.